SIP Calculator: Complete Guide to Systematic Investment Planning

📊 What is SIP? Understanding Systematic Investment Plans

Systematic Investment Plan (SIP) is an investment strategy where you invest a fixed amount regularly (usually monthly) in mutual funds, stocks, or other financial instruments. Unlike lump-sum investments, SIP focuses on regular, disciplined investing regardless of market conditions.

The Philosophy Behind SIP:

- 💰 Disciplined Approach: Regular investments cultivate financial discipline

- 📊 Market Neutral: Invests consistently through market ups and downs

- 🎯 Long-term Focus: Designed for wealth creation over years

- 🔄 Automated Process: Set it and forget it approach

Historical Context:

SIP originated from the concept of dollar-cost averaging in the 1940s. It was popularized by mutual fund companies in India in the 1990s and has since become the preferred investment method for millions of Indians, with over ₹18,000 crore invested monthly through SIPs.

🎯 Why SIP? The Core Benefits and Purpose

1. Financial Discipline Creation

The Problem: Most people struggle with consistent saving and investing habits. SIP Solution:

- ⏰ Automated Deductions: Money invested before spending

- 📅 Calendar Discipline: Fixed investment dates each month

- 💪 Habit Formation: Builds long-term investment habits

- 🎯 Goal Alignment: Links investments to specific financial objectives

2. Rupee Cost Averaging Advantage

The Concept: Buying more units when prices are low, fewer when prices are high. How It Works:

Month 1: NAV ₹100 → Invest ₹5,000 = 50 units

Month 2: NAV ₹80 → Invest ₹5,000 = 62.5 units

Month 3: NAV ₹120 → Invest ₹5,000 = 41.6 units

Total: ₹15,000 invested = 154.1 units

Average Cost: ₹97.34 per unit

Benefits:

- 📉 Reduces Average Cost: Lowers overall purchase price

- 🔄 Market Volatility Protection: Smooths out price fluctuations

- 📊 Emotional Control: Removes timing anxiety

- 🎯 Consistent Accumulation: Steady unit accumulation

3. Power of Compounding

The Magic Formula: Your returns generate their own returns. Example Impact:

- ₹5,000 monthly SIP at 12% for 20 years

- Total Investment: ₹12,00,000

- Maturity Value: ₹49,95,000

- Compounded Returns: ₹37,95,000 (316% of investment)

Why It Matters:

- 📈 Exponential Growth: Returns accelerate over time

- ⏳ Time Advantage: Longer duration = higher compounding

- 💰 Wealth Multiplier: Transforms small amounts into significant wealth

- 🎯 Patience Rewarded: Long-term investors benefit most

4. Accessibility and Flexibility

For All Investors:

- 💵 Low Entry: Start with just ₹500 monthly

- 📱 Easy Setup: Online or through apps

- 🔄 Flexible Amounts: Increase/decrease as per capacity

- 📅 Adjustable Frequency: Monthly, quarterly options

📈 How SIP Actually Works: The Complete Process

Step 1: Goal Identification

Questions to Ask:

- What am I investing for? (Education, Retirement, Home, etc.)

- How much do I need?

- When do I need it?

- What's my risk tolerance?

Common Goals:

- 🎓 Child Education: 15-20 year horizon

- 👵 Retirement: 20-30 year horizon

- 🏠 Home Purchase: 5-10 year horizon

- ✈️ Vacation: 1-3 year horizon

Step 2: Fund Selection

Types of Funds for SIP:

Equity Funds (High Risk, High Return)

- 📈 Large Cap: Stable companies, moderate growth

- 🔄 Mid Cap: Growing companies, higher potential

- 🚀 Small Cap: High growth, high volatility

- 🌍 International: Global market exposure

Debt Funds (Lower Risk, Stable Returns)

- 🏦 Liquid Funds: Short-term, high liquidity

- 📊 Income Funds: Medium-term, steady income

- 🎯 Gilt Funds: Government securities, safest

Hybrid Funds (Balanced Approach)

- ⚖️ Balanced Advantage: Dynamic equity-debt mix

- 📈 Equity Savings: Tax-efficient, moderate risk

- 🔄 Multi-asset: Diversified across assets

Step 3: SIP Registration

Methods Available:

- Directly with AMC: Visit fund house website

- Through Distributor: Financial advisor assistance

- Online Platforms: Zerodha, Groww, Upstox

- Bank Platforms: Most banks offer SIP services

Documents Needed:

- 📋 PAN Card

- 🏦 Bank Details (Cancelled cheque/statement)

- 📸 KYC Documents

- 📱 Mobile Number and Email

Step 4: Automated Investing

Monthly Process:

- Date Fixed: Choose 1st, 5th, 10th, etc.

- Auto-debit: Bank automatically transfers amount

- Units Allocated: Based on that day's NAV

- Statement Generated: Monthly investment confirmation

Step 5: Monitoring and Review

Regular Checkpoints:

- 📊 Monthly: Verify deductions

- 📈 Quarterly: Review performance

- 🎯 Annually: Rebalance if needed

- 🔄 Goal Milestones: Major progress checks

🏆 Key Benefits of SIP Investing

1. Psychological Advantages

Emotional Benefits:

- 😌 Reduces Anxiety: No need to time the market

- 🧠 Eliminates Guesswork: Systematic approach

- 💪 Builds Confidence: Visible progress over time

- 🎯 Creates Certainty: Predictable investment pattern

2. Financial Advantages

Economic Benefits:

- 💰 Affordability: Start small, increase gradually

- 📈 Wealth Creation: Significant long-term growth

- 🛡️ Inflation Protection: Real returns beat inflation

- 🎯 Goal Achievement: Systematic approach to targets

3. Practical Advantages

Convenience Factors:

- ⚡ Automation: Set once, run forever

- 📱 Accessibility: Manage from anywhere

- 🔄 Flexibility: Pause, increase, decrease anytime

- 📊 Transparency: Clear statements and tracking

📊 Understanding SIP Mathematics

The SIP Formula Explained

Basic Calculation:

A = P × [(1 + r)^n - 1] / r × (1 + r)

Where:

A = Maturity amount

P = Monthly investment

r = Monthly interest rate (annual rate ÷ 12)

n = Number of months

Real-world Calculation Example

Scenario: ₹10,000 monthly for 15 years at 12%

Calculation Steps:

- Monthly Rate: 12% ÷ 12 = 1% = 0.01

- Total Months: 15 × 12 = 180 months

- Apply Formula: ₹10,000 × [(1.01¹⁸⁰ - 1) ÷ 0.01] × 1.01

- Result: ₹50,00,000 approximately

Key Insights:

- 💰 Investment: ₹18,00,000

- 📈 Returns: ₹32,00,000

- 🎯 Multiplier: 2.77x investment

Impact of Different Variables

1. Time Duration Impact

₹10,000 monthly at 12%

10 years: ₹23 lakhs

15 years: ₹50 lakhs

20 years: ₹99 lakhs

25 years: ₹1.87 crores

Insight: Time is the most powerful variable

2. Return Rate Impact

₹10,000 monthly for 20 years

10% returns: ₹76 lakhs

12% returns: ₹99 lakhs

15% returns: ₹1.5 crores

Insight: Small % differences create huge gaps

3. Investment Amount Impact

20 years at 12%

₹5,000 monthly: ₹50 lakhs

₹10,000 monthly: ₹99 lakhs

₹20,000 monthly: ₹1.98 crores

Insight: Amount matters, but consistency matters more

🎯 Practical Applications: When to Use SIP

1. Salary Earners

Best For:

- 🏢 Corporate Employees: Regular monthly income

- 👨💼 Professionals: Doctors, lawyers, engineers

- 🏛️ Government Employees: Stable income streams

- 💼 Business Owners: Regular business income

Strategy:

- 💰 Percentage of Salary: 10-20% of monthly income

- 📅 Post-Payday Investment: Immediately after salary credit

- 🔄 Annual Increase: Increase SIP with salary hikes

2. Young Professionals (22-30 years)

Advantages:

- ⏳ Time Advantage: Maximum compounding benefit

- 💰 Low Commitment: Can start with small amounts

- 📈 Risk Capacity: Can handle equity volatility

- 🎯 Goal Setting: Early start on major goals

Recommended:

- 📊 80% Equity: For long-term growth

- 💵 20% Debt: For stability

- 🔄 Step-up SIP: Increase 10% annually

3. Middle-aged Investors (30-50 years)

Considerations:

- 🏠 Multiple Goals: Children, home, retirement

- ⚖️ Risk Balance: Moderate risk approach

- 📈 Acceleration Needed: Higher investment amounts

- 🎯 Goal Prioritization: Clear timeline focus

Strategy:

- ⚖️ 50-50 Split: Balanced equity-debt mix

- 💰 Higher SIP: Maximum affordable amount

- 📊 Goal Segregation: Separate SIPs for each goal

4. Pre-retirement (50-60 years)

Focus Areas:

- 👵 Capital Preservation: Protect accumulated wealth

- 💵 Regular Income: Transition to income generation

- 🛡️ Risk Reduction: Shift to safer instruments

- 🎯 Legacy Planning: Wealth transfer considerations

Strategy:

- 🏦 80% Debt: Capital protection focus

- 📈 20% Equity: Inflation beating component

- 🔄 SWP Setup: Systematic withdrawal planning

📈 Advanced SIP Strategies

1. Step-up SIP (Top-up SIP)

Concept: Increasing SIP amount annually

Implementation:

- 📈 Fixed Percentage: 10-15% annual increase

- 💰 Salary-linked: Increase with income growth

- 🎯 Inflation-adjusted: Maintain purchasing power

- 🔄 Automatic: Set up auto-increase feature

Impact Example:

Start: ₹10,000 monthly

Annual Increase: 10%

Year 1: ₹1.2 lakhs invested

Year 5: ₹1.76 lakhs invested

Year 10: ₹2.85 lakhs invested

Total 10 years: ₹19.2 lakhs invested

2. Multi-goal SIP Planning

Separate SIPs for Different Goals:

Portfolio Structure:

- Education SIP: Equity-heavy, 15-year horizon

- Retirement SIP: Balanced, 20-year horizon

- Emergency SIP: Liquid/debt, accessible

- Vacation SIP: Short-term, conservative

Benefits:

- 🎯 Goal Clarity: Each SIP has clear purpose

- 📊 Performance Tracking: Individual goal monitoring

- 🔄 Flexible Adjustment: Change one without affecting others

- 💰 Psychological Satisfaction: Visible progress on each goal

3. SIP in Different Market Conditions

Bull Market Strategy:

- 📈 Continue Normally: Don't stop or reduce

- 💰 Consider Top-up: Add extra during good times

- 📊 Review Allocation: Ensure proper diversification

- 🎯 Stay Disciplined: Avoid emotional decisions

Bear Market Strategy:

- 📉 Increase SIP: Buy more units at lower prices

- 💪 Stay Committed: This is when SIP works best

- 🔄 Reassess Goals: Ensure timelines are realistic

- 🛡️ Maintain Emergency Fund: Don't compromise liquidity

4. Tax-efficient SIP Planning

ELSS for Tax Saving:

- 📋 Section 80C: ₹1.5 lakh deduction

- ⏳ 3-year Lock-in: Minimum holding period

- 📈 Equity Growth: Potential for good returns

- 🎯 Dual Purpose: Tax saving + wealth creation

Strategy:

- 💰 Monthly ELSS SIP: ₹12,500 monthly for 80C limit

- 📊 Combine with Other: PPF, insurance, home loan

- 🎯 Long-term Hold: Continue beyond lock-in period

- 🔄 Auto-renewal: Set up annual SIP renewal

🚨 Common SIP Mistakes to Avoid

1. Stopping SIP During Market Downturns

Mistake: Discontinuing when markets fall Correction: This is the best time to continue - you get more units Solution:

- 💪 Mental Preparation: Understand market cycles

- 📊 Historical Perspective: Markets always recover

- 🎯 Goal Focus: Remember long-term objectives

2. Chasing Past Performance

Mistake: Selecting funds based only on last year's returns Correction: Past performance doesn't guarantee future results Solution:

- 📈 Consistent Performers: 3-5 year track record

- 🏢 Fund House Quality: Reputation and management

- 🔄 Diversification: Spread across fund categories

3. Ignoring Expense Ratios

Mistake: Not considering fund management costs Correction: High expenses reduce net returns significantly Solution:

- 💰 Direct Plans: Lower expense ratios

- 📊 Compare Costs: Regular vs. direct plans

- 🎯 Long-term Impact: Calculate 20-year cost difference

4. No Goal Alignment

Mistake: Investing without clear objectives Correction: Goals determine investment strategy Solution:

- 🎯 Define Goals: Specific, measurable, time-bound

- 📅 Match Horizon: Equity for long-term, debt for short-term

- 💰 Calculate Requirements: Use SIP calculator

5. Frequent Switching

Mistake: Changing funds too often Correction: SIP requires patience and consistency Solution:

- 📊 Annual Review: Evaluate once a year

- 🎯 Performance Parameters: Compare with benchmark

- 🔄 Strategic Changes: Only for major underperformance

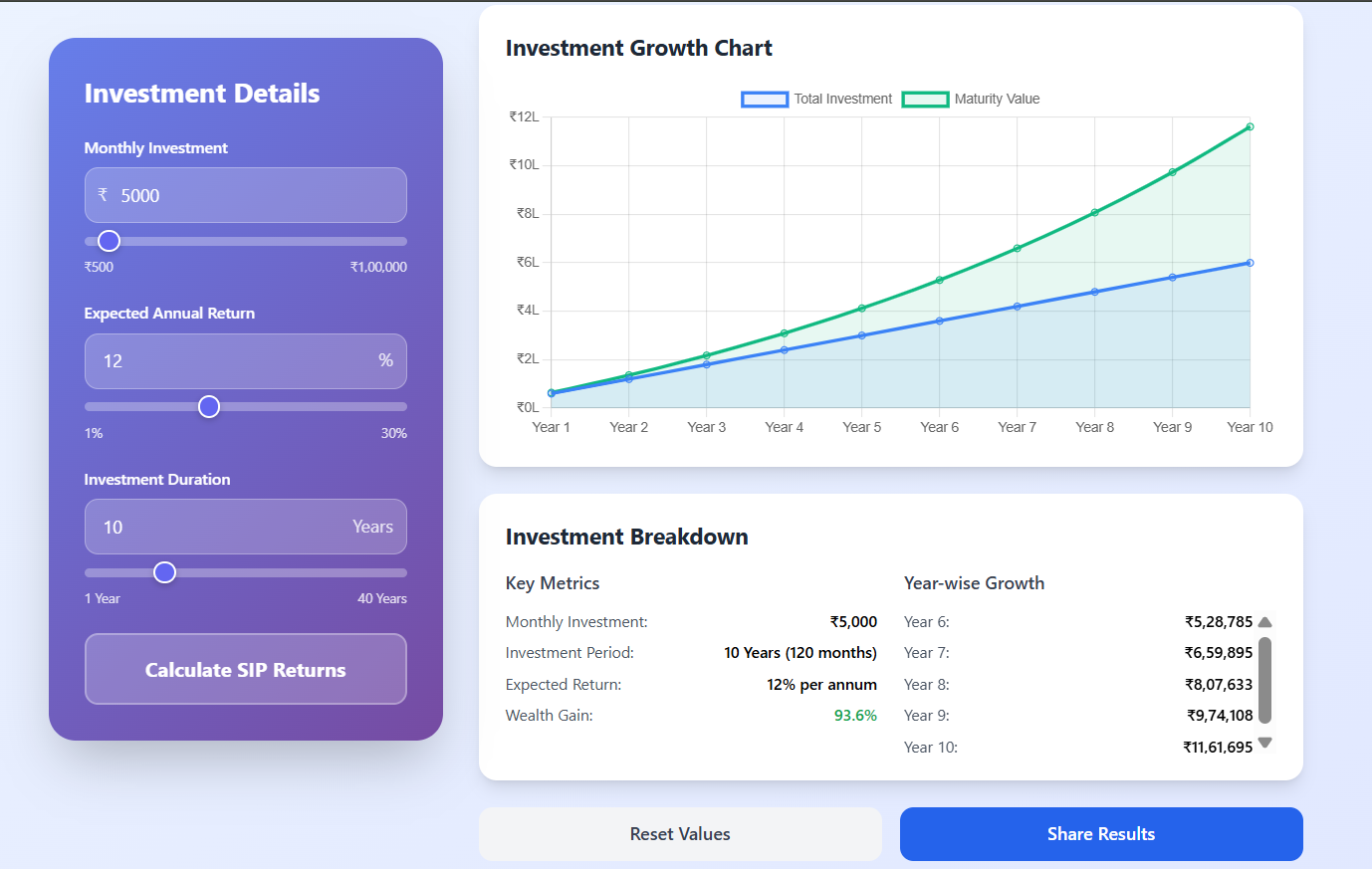

📱 Using SIP Calculators Effectively

What a Good SIP Calculator Should Provide

Essential Features:

Flexible Inputs:

- 💰 Investment amount range

- 📅 Duration options

- 📈 Return rate adjustments

Comprehensive Outputs:

- 📊 Total investment amount

- 📈 Estimated returns

- 🎯 Maturity value

- 💰 Year-wise breakdown

Visual Representations:

- 📈 Growth charts

- 📊 Comparative graphs

- 🔄 Progress visualization

Scenario Analysis:

- 🔄 What-if calculations

- 📊 Different return scenarios

- 💰 Various investment amounts

How to Use SIP Calculator for Planning

Step 1: Goal Back Calculation

Goal: ₹1 crore for retirement in 20 years

Expected returns: 12%

Calculator shows: ₹13,500 monthly needed

Step 2: Affordability Check

Monthly savings capacity: ₹20,000

Calculator shows: Potential ₹1.48 crores in 20 years

Step 3: Risk Assessment

Conservative (8%): ₹73 lakhs

Moderate (12%): ₹1.48 crores

Aggressive (15%): ₹2.45 crores

Step 4: Timeline Adjustment

If can't afford ₹13,500 monthly:

Option 1: Extend to 25 years → ₹7,800 monthly

Option 2: Increase returns to 15% → ₹9,200 monthly

Option 3: Combine both → ₹5,500 monthly

🏦 SIP vs Other Investment Options

SIP vs Lump Sum Investment

SIP Advantages:

- 📊 Risk Management: Spreads market timing risk

- 💰 Affordability: Doesn't require large capital

- 🔄 Discipline: Regular investment habit

- 🎯 Emotional Control: Removes timing anxiety

Lump Sum Advantages:

- 📈 Higher Potential: More time in market

- 💰 Simplicity: One-time decision

- 🔄 Less Monitoring: Set and forget

- 📊 Certainty: Known investment amount

When to Choose SIP:

- 📅 Regular Income: Salary earners

- 💰 Limited Capital: Starting small

- 🎯 Risk Averse: Want to reduce timing risk

- 🔄 Long-term: 5+ year horizon

When to Choose Lump Sum:

- 💵 Large Amount: Inheritance, bonus, sale proceeds

- 📈 Market Timing: When markets are clearly low

- 🎯 Certainty: Exact amount available

- 📊 Simplicity: Prefer one-time action

SIP vs Recurring Deposits (RD)

SIP (Equity Mutual Funds):

- 📈 Returns: 10-15% historically

- 🔄 Liquidity: T+2 days redemption

- 💰 Taxation: LTCG after 1 year (10% above ₹1 lakh)

- 🎯 Risk: Market linked, variable returns

Bank RD:

- 📊 Returns: 5-7% fixed

- 🔄 Liquidity: Premature withdrawal penalty

- 💰 Taxation: Interest taxed as per income slab

- 🎯 Risk: Capital guaranteed

Recommendation:

- 📈 Long-term Goals: SIP for higher growth

- 💰 Short-term Goals: RD for capital protection

- 🔄 Emergency Fund: RD or liquid funds

- 🎯 Diversified Portfolio: Mix of both

SIP vs PPF

SIP Flexibility:

- 💰 Amount: Any amount, any time

- 📅 Duration: Flexible tenure

- 🔄 Withdrawal: Any time after 1 year

- 📈 Returns: Market linked

PPF Features:

- 💰 Amount: Minimum ₹500, maximum ₹1.5 lakh/year

- 📅 Duration: 15 years fixed

- 🔄 Withdrawal: Limited, after 6 years

- 📈 Returns: Government fixed rate (~7.1%)

Strategic Combination:

- 📋 Tax Planning: PPF for 80C, SIP for additional

- 🎯 Goal Segregation: PPF for secure goals, SIP for growth goals

- 💰 Risk Balance: PPF for safety, SIP for growth

📊 Monitoring and Reviewing Your SIP

Regular Checkpoints

Monthly:

- ✅ Deduction Confirmation: Check bank statement

- 📊 Unit Statement: Verify units allocated

- 💰 Amount Consistency: Ensure correct amount debited

Quarterly:

- 📈 Performance Check: Compare with benchmark

- 🔄 Goal Progress: Track against timeline

- 💰 Amount Review: Assess affordability

Annually:

- 🎯 Goal Review: Adjust for life changes

- 📊 Portfolio Rebalance: Maintain asset allocation

- 💰 SIP Increase: Annual step-up implementation

- 📋 Tax Planning: ELSS and other tax-saving

Performance Parameters to Track

Absolute Returns:

- 💰 Formula: (Current Value - Invested) / Invested × 100

- 🎯 Benchmark: Compare with inflation (6-7%)

Annualized Returns (CAGR):

- 📈 Formula: [(Current/Invested)^(1/years) - 1] × 100

- 🎯 Benchmark: Compare with category average

Risk-adjusted Returns:

- ⚖️ Measure: Returns per unit of risk

- 📊 Tools: Sharpe ratio, Sortino ratio

- Peer Comparison:

- 🔄 Compare: Similar fund category performance

- 📈 Duration: 3-5 year performance

When to Make Changes

Consider Changing SIP If:

Consistent Underperformance:

- 📉 Criteria: 2+ years below category average

- 🔄 Action: Switch to better performing fund

Goal Changes:

- 🎯 Example: Earlier retirement planned

- 💰 Action: Increase SIP amount

Risk Profile Change:

- 👵 Example: Approaching retirement

- ⚖️ Action: Shift to more debt allocation

Fund House Issues:

- 🏢 Criteria: Management changes, regulatory issues

- 🔄 Action: Move to different fund house

Don't Change For:

- 📉 Short-term Performance: 6-12 month fluctuations

- 📰 Media Reports: Sensational market news

- 💬 Friend's Advice: Without proper research

- 😰 Market Volatility: Normal market movements

🎯 Creating Your SIP Investment Plan

Step-by-Step Planning Guide

Step 1: Self-Assessment

1. Current Age: ______

2. Retirement Age Goal: ______

3. Monthly Income: ₹______

4. Monthly Expenses: ₹______

5. Existing Investments: ₹______

6. Risk Tolerance: Low/Medium/High

7. Financial Goals List:

- Goal 1: ______ (Amount: ₹______, Years: __)

- Goal 2: ______ (Amount: ₹______, Years: __)

- Goal 3: ______ (Amount: ₹______, Years: __)

Step 2: SIP Requirement Calculation

For Each Goal:

Use SIP Calculator with:

- Required Amount: Goal amount

- Time Available: Years to goal

- Expected Returns: Based on risk profile

- Calculate: Monthly SIP needed

Example:

Goal: Child Education ₹50 lakhs in 15 years

Expected returns: 12%

SIP Calculator shows: ₹11,500 monthly

Step 3: Fund Selection Strategy

Based on Time Horizon:

1. <3 years: Liquid/Debt Funds

2. 3-7 years: Hybrid/Balanced Funds

3. 7+ years: Equity Funds

Based on Risk Profile:

1. Conservative: 30% Equity, 70% Debt

2. Moderate: 60% Equity, 40% Debt

3. Aggressive: 80% Equity, 20% Debt

Step 4: Implementation Plan

Monthly Investment Schedule:

Date 1: ₹______ in Fund A (Goal 1)

Date 5: ₹______ in Fund B (Goal 2)

Date 10: ₹______ in Fund C (Goal 3)

Date 15: ₹______ in ELSS (Tax Saving)

Auto-debit Setup:

- Bank Registration

- Date Selection

- Amount Confirmation

- Standing Instruction

Step 5: Monitoring Framework

Tracking Sheet:

1. Monthly: Verify deductions

2. Quarterly: Performance vs benchmark

3. Half-yearly: Goal progress check

4. Annually: Comprehensive review

Review Parameters:

- Absolute Returns

- Goal Achievement %

- Portfolio Rebalancing

- SIP Increase Decision

Sample SIP Portfolio for Different Ages

Age 25-35 (Wealth Accumulation Phase):

Total SIP: ₹25,000 monthly

1. Large Cap Fund: ₹7,500 (30%)

2. Mid Cap Fund: ₹7,500 (30%)

3. Small Cap Fund: ₹5,000 (20%)

4. ELSS Fund: ₹5,000 (20%)

Strategy: Growth focused, high equity

Review: Annual portfolio rebalancing

Step-up: 10% annual increase

Age 35-50 (Goal-focused Phase):

Total SIP: ₹50,000 monthly

1. Child Education (15 years): ₹15,000 in Equity

2. Retirement (20 years): ₹20,000 in Balanced

3. Home Purchase (10 years): ₹10,000 in Hybrid

4. Tax Saving: ₹5,000 in ELSS

Strategy: Goal segregation, moderate risk

Review: Semi-annual goal tracking

Age 50-60 (Pre-retirement Phase):

Total SIP: ₹30,000 monthly

1. Debt Funds: ₹15,000 (50%)

2. Balanced Funds: ₹10,000 (33%)

3. Equity Funds: ₹5,000 (17%)

Strategy: Capital preservation, income focus

Review: Quarterly risk assessment

📈 The Future of SIP Investing

Emerging Trends

1. Digital Transformation:

- 📱 App-based Management: Complete mobile control

- 🤖 Robo-advisors: Automated portfolio management

- 📊 AI Analytics: Predictive performance insights

- 🔄 API Integration: Seamless bank connections

2. Product Innovation:

- 🎯 Goal-based SIPs: Customized for specific objectives

- 🔄 Dynamic SIP: Amount varies with market levels

- 📊 Multi-asset SIP: Automatic asset allocation

- 💰 SIP + Insurance: Combined investment-protection

3. Regulatory Improvements:

- 🏛️ Simpler KYC: Faster onboarding

- 📋 Transparent Charges: Clear expense disclosure

- 🔒 Enhanced Security: Better fraud protection

- 📊 Standardized Reporting: Uniform performance metrics

Technology Impact

Blockchain Applications:

- 🔒 Secure Transactions: Tamper-proof records

- ⚡ Faster Processing: Reduced settlement time

- 📊 Transparent Tracking: Real-time unit allocation

- 🔄 Smart Contracts: Automated rule execution

AI and Machine Learning:

- 🎯 Personalized Recommendations: Custom SIP plans

- 📈 Predictive Analytics: Return projections

- ⚖️ Risk Assessment: Dynamic risk profiling

- 🔄 Auto-rebalancing: Intelligent portfolio management

🏆 Success Stories and Case Studies

Real-life Examples

Case Study 1: The Early Starter

Age: Started at 25

SIP: ₹5,000 monthly in equity funds

Duration: 35 years (till 60)

Return: 12% average

Result: ₹2.3 crores corpus

Investment: ₹21 lakhs total

Returns: ₹2.09 crores (10x investment)

Key Insight: Starting early with small amount

Case Study 2: The Consistent Investor

Age: Started at 30

SIP: ₹10,000 monthly, increased 10% yearly

Duration: 30 years

Return: 12% average

Result: ₹4.8 crores corpus

Investment: ₹1.97 crores total

Returns: ₹2.83 crores

Key Insight: Regular step-ups magnify results

Case Study 3: The Goal Achiever

Goal: Child's US education ($100,000)

Start: When child was 5 years old

SIP: ₹25,000 monthly in international funds

Duration: 13 years

Return: 10% average

Result: Achieved $100,000 target

Key Insight: Clear goal + appropriate fund selection

Lessons from Successful SIP Investors

Common Traits:

- Discipline: Never missed SIP even in bad markets

- Patience: Stayed invested through multiple cycles

- Goal Focus: Always linked to specific objectives

- Continuous Learning: Regularly updated knowledge

- Systematic Approach: Followed planned strategy

🎯 Conclusion: Your SIP Journey Begins Here

Key Takeaways

SIP is Not Just an Investment, It's a Habit

- 💪 Builds financial discipline

- 🎯 Creates wealth systematically

- 📊 Removes emotional investing

- 🔄 Works in all market conditions

The Power is in Consistency

- ⏳ Time enhances compounding

- 💰 Regularity beats timing

- 📈 Small amounts become significant

- 🎯 Goals become achievable

Success Requires Planning

- 📋 Clear goal definition

- 📊 Appropriate fund selection

- 🔄 Regular monitoring

- 🎯 Periodic adjustments

Your Action Plan

Immediate Actions (This Week):

- 👉 Use SIP Calculator to assess needs

- 🎯 Define your top 3 financial goals

- 💰 Calculate required monthly SIP amounts

- 🏦 Check bank balance for auto-debit setup

Short-term Actions (This Month):

- 📋 Complete KYC if not done

- 🏢 Select 2-3 reputable fund houses

- 📊 Decide fund categories based on goals

- 🔄 Set up first SIP auto-debit

Long-term Commitment:

- 📅 Stay invested through market cycles

- 💰 Increase SIP with income growth

- 📊 Annual portfolio review

- 🎯 Celebrate goal achievements

Final Thought

The journey of ₹1 crore begins with a single SIP of ₹500. The market will have ups and downs, economic conditions will change, but your systematic investment discipline will remain your constant wealth-creation engine.

Remember:

- The best time to start SIP was 20 years ago

- The second-best time is today

- The worst time is "someday"

Start small, stay consistent, think long-term, and let the power of systematic investing transform your financial future.

👉 Begin Your SIP Journey Today - Free Planning

Tags: sip guide, systematic investment plan, mutual fund sip, investment planning, wealth creation, financial planning, sip benefits, investment strategies, long-term investing, financial goals, personal finance, wealth management