💰 Global Salary Calculator: Calculate Your Net Pay & Effective Tax Rate Instantly

🌎 Introduction

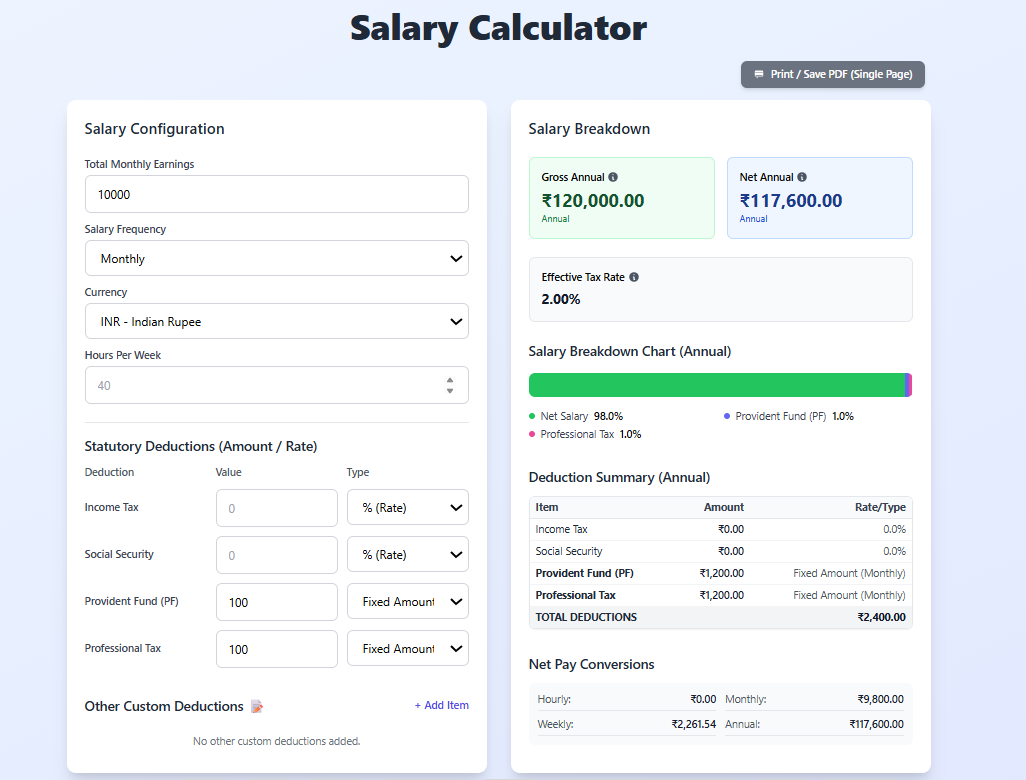

Understanding your true take-home salary--Net Pay--can be complicated, especially when dealing with different pay frequencies, currencies, and statutory deductions like Income Tax, Social Security, and Provident Funds (PF). Without a precise understanding, you may underestimate expenses, overestimate savings, or miss out on benefits.

Solvezi's Global Salary Calculator is designed to simplify this process. It provides a clear breakdown of gross earnings, mandatory and custom deductions, and final net pay across hourly, weekly, monthly, and annual rates.

Whether you are a job seeker negotiating offers, a freelancer calculating tax liabilities, or a finance enthusiast managing personal budgets, this tool empowers you to understand exactly where your money is going.

👉 Try it now: Global Salary Calculator

--

💡 How the Calculator Works

1. Core Inputs & Annualization

The calculator begins by standardizing your salary across the year. Depending on whether you input your salary as hourly, weekly, monthly, or annual, it converts it to Gross Annual Salary. Additionally, inputs such as Hours Per Week and Weeks Per Year help calculate your net hourly rate.

| Input Field | Example | Purpose |

|---|---|---|

| Salary Amount | 50,000 | Base payment amount (Gross Earnings) |

| Salary Frequency | Monthly | Frequency of the salary input |

| Currency | INR / USD / EUR | Formats results in selected currency |

| Hours Per Week | 40 | Used to calculate net hourly rate |

| Weeks Per Year | 52 | Converts weekly/hourly pay to annual figures |

This standardization allows users from different countries or industries to compare and understand their compensation consistently.

2. Deduction Calculation Logic

Deductions may be statutory (Income Tax, Social Security, PF) or custom (loan payments, insurance, etc.). They can be fixed or percentage-based. The calculator annualizes these automatically for clarity.

- Percentage Deduction:

Gross Annual Salary × (Percentage / 100) - Fixed Monthly Deduction:

Fixed Amount × 12

For example, if you pay a monthly PF of $200, the annual PF is $200 × 12 = $2,400. Similarly, if income tax is 15%, it calculates as Gross Annual Salary × 0.15.

--

⚙️ Key Features

- Universal Deductions: Handles statutory deductions including Income Tax, Social Security, Provident Fund (PF), and Professional Tax.

- Custom Deductions: Add recurring personal deductions as fixed amounts or percentages.

- Frequency Conversion: Instantly view net pay in Hourly, Weekly, Monthly, or Annual format.

- Visual Breakdown: Charts show Net Pay vs Total Deductions.

- Print/PDF Export: Save or print full salary breakdown for records or negotiations.

- Multi-currency Support: Format results in INR, USD, EUR, GBP, and more.

- Scenario Analysis: Compare multiple offers or deduction scenarios to make informed decisions.

--

📊 Step-by-Step Salary Calculation Example

Let’s go through a typical monthly salary calculation for clarity.

Step 1: Input Your Base Salary

Example: Monthly salary = $5,000 USD, 40 hours/week, 52 weeks/year.

Step 2: Annualize Gross Salary

$5,000 × 12 months = $60,000 Gross Annual Salary.

Step 3: Apply Mandatory Deductions

- Income Tax (20%) → $60,000 × 0.20 = $12,000

- Social Security (6%) → $60,000 × 0.06 = $3,600

- Provident Fund / Retirement Contribution (5%) → $60,000 × 0.05 = $3,000

Total Deductions = $12,000 + $3,600 + $3,000 = $18,600

Step 4: Calculate Net Salary

Net Annual Salary = $60,000 − $18,600 = $41,400

Step 5: Frequency Breakdown

- Monthly: $41,400 ÷ 12 = $3,450/month

- Weekly: $41,400 ÷ 52 = $796/week

- Hourly: $41,400 ÷ (52 × 40) = $19.90/hour

This walkthrough demonstrates how the calculator provides instant clarity on earnings.

--

🧮 Understanding Deductions

Mandatory Deductions

- Income Tax: Varies by country, progressive or flat rates. The calculator uses your input rate to determine actual tax liability.

- Social Security / National Insurance: Covers retirement and health benefits.

- Provident Fund / Pension Contributions: Retirement savings contribution, often matched by employers.

- Professional Tax / Local Levies: Country-specific mandatory deductions.

Custom Deductions

- Loan repayments

- Health Insurance Premiums

- Investment Contributions

- Union Dues

By factoring both mandatory and custom deductions, users get a realistic view of spendable income.

Effective Tax Rate

Calculated as (Total Deductions / Gross Salary) × 100. This helps benchmark tax liabilities against peers and make informed financial decisions.

--

🎯 Practical Use Cases

| Role | Use Case | Benefit |

|---|---|---|

| Employees | Input salary & deductions to see net pay | Accurate monthly budgeting |

| HR / Payroll Staff | Audit payroll & verify effective tax rate | Ensure compliance with laws |

| Job Seekers | Compare offers with varying deductions | Make informed career decisions |

| Freelancers | Plan taxes and expenses | Optimize net income |

| Financial Planners | Simulate savings or debt payments | Plan cash flow and investments |

--

💡 Common Salary Misconceptions

- Gross Salary is Take-Home: Many assume gross = take-home. Mandatory deductions reduce net income significantly.

- All Countries Have Same Deductions: Social security, PF, and tax structures differ by country. Manual input ensures accuracy.

- Bonuses Are Always Net: Bonuses are often taxed separately; include them in calculations to avoid surprises.

- Salary Frequency Doesn’t Affect Planning: Weekly, bi-weekly, or monthly payouts impact budgeting and cash flow.

--

📈 Interpreting Charts & Visual Breakdowns

The calculator provides charts to visualize deductions vs net pay:

- Pie Chart: Shows the proportion of deductions vs net pay.

- Bar Chart: Compares different pay frequencies.

- Trend Analysis: Useful for annual budgeting, seeing how deductions accumulate over time.

These visualizations help you make informed decisions quickly.

--

💬 FAQs

- Q1: Gross vs Net Salary?

- Gross = total pay before deductions; Net = take-home pay.

- Q2: Is this calculator country-specific?

- No. Enter country-specific rates manually.

- Q3: How is a fixed monthly deduction annualized?

- Multiplied by 12.

- Q4: Can I change the currency?

- Yes, formats results in selected currency.

- Q5: Should HRA/DA be included in Salary Amount?

- Yes, total gross earnings should be input.

- Q6: Is my data stored?

- No, calculations are local and private.

- Q7: How are bonuses handled?

- Input as separate income; tax deductions apply proportionally.

- Q8: Can overtime be calculated?

- Yes, enter hourly rate and hours to see overtime impact.

- Q9: How to compare international salaries?

- Use local currency rates and adjust deductions manually.

- Q10: What if I have multiple custom deductions?

- The tool allows adding as many fixed or percentage deductions as needed.

--

🏁 Conclusion

The Solvezi Global Salary Calculator is a comprehensive tool for understanding and planning your personal finances. It provides:

- Accurate net salary breakdown

- Visualization of deductions vs take-home pay

- Flexibility for custom deductions, currencies, and pay frequencies

Gain clarity, plan better, and negotiate confidently.

👉 Start calculating now: Global Salary Calculator

--

Tags: global salary, net pay calculator, income tax, pf deduction, professional tax, payroll tool, finance-tools